If you’re self-employed, understanding how to calculate your self-employment tax is crucial. In 2024, this tax consists of Social Security and Medicare taxes, similar to what employees pay, but you cover both the employer and employee portions. Let’s break it down with some examples.

What is Self-Employment Tax?

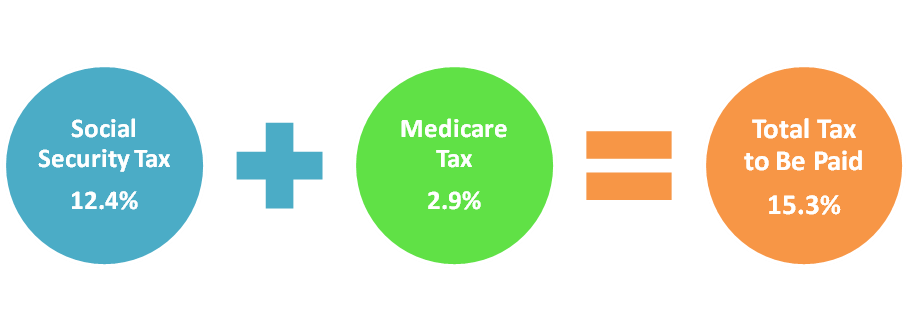

Self-employment tax in the USA includes:

- Social Security Tax: 12.4% on income up to $168,600.

- Medicare Tax: 2.9% on all income.

This adds up to a total tax of 15.3% on income up to $168,600.

However, the tax is calculated on 92.35% of your net self-employment income.

How to Calculate Self-Employment Tax

To calculate your self-employment tax, follow these steps:

- Determine your net income from self-employment.

- Multiply your net income by 92.35%.

- Apply the 15.3% tax rate on this adjusted income.

Let’s see how this works with three different income levels.

Example 1: Income of $20,000

- Calculate 92.35% of $20,000:

- $20,000 × 92.35% = $18,470

- Calculate the self-employment tax:

- $18,470 × 15.3% = $2,826.91

Your self-employment tax for $20,000 of income is $2,826.91.

Example 2: Income of $100,000

- Calculate 92.35% of $100,000:

- $100,000 × 92.35% = $92,350

- Calculate the self-employment tax:

- $92,350 × 15.3% = $14,123.55

Your self-employment tax for $100,000 of income is $14,123.55.

Example 3: Income of $200,000

- Calculate 92.35% of $200,000:

- $200,000 × 92.35% = $184,700

- Apply the Social Security tax to income up to $168,600:

- $168,600 × 12.4% = $20,906.40

- Apply the Medicare tax to all income:

- $184,700 × 2.9% = $5,356.30

- Add both taxes:

- $20,906.40 + $5,356.30 = $26,262.70

Your self-employment tax for $200,000 of income is $26,262.70.

Conclusion

Calculating self-employment tax may seem complicated, but with these steps, you can estimate your tax based on your income level. Understanding this helps you plan better for your financial obligations, ensuring you’re prepared come tax time.