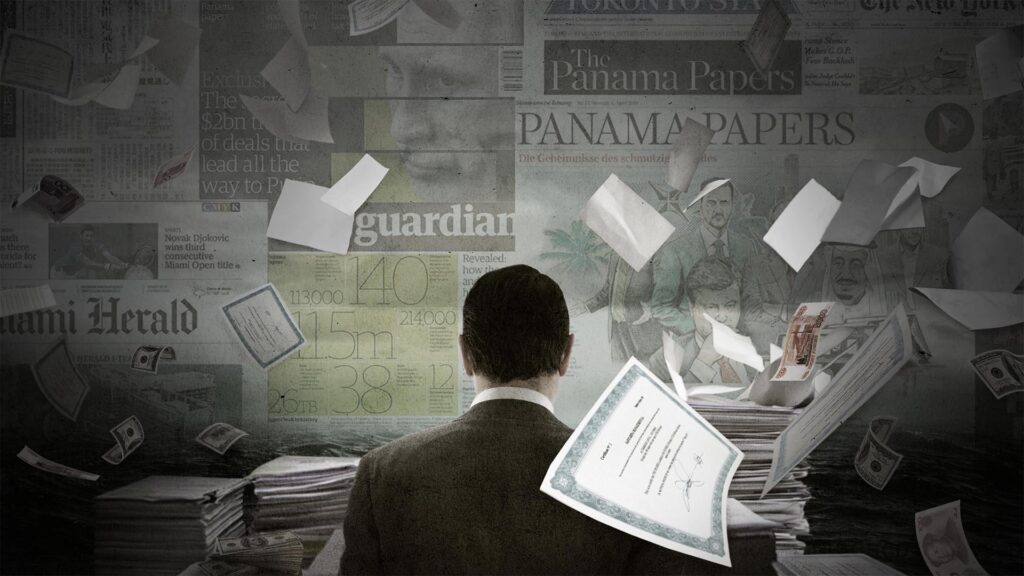

Introduction: In the annals of financial history, the Panama Papers Scandal stands as a testament to the intricate web of offshore tax evasion that the world’s elite used to hide assets and evade taxes. The revelation of this massive data leak from the Panama-based law firm Mossack Fonseca brought to light the nefarious mechanisms of tax evasion, emphasizing the role of intermediaries, the use of letterbox companies, manipulation of transfer prices, and the allure of tax havens. This article delves into the depths of the scandal, examining its repercussions and the subsequent global push for reform.

The Intricate Mechanisms of Tax Evasion: The heart of the Panama Papers Scandal lies in the complex mechanisms orchestrated by corporate groups to manipulate profits and evade taxes. Intermediaries such as financial institutions, trust companies, law, and accounting firms played a pivotal role in establishing offshore entities, commonly known as “letterbox companies.” These entities, devoid of real operations, acted as conduits for financial transactions, exploiting favorable tax laws.

Transfer pricing emerged as another tactic, allowing companies to manipulate costs assigned to goods and services between related entities within an enterprise. By doing so, profits were surreptitiously shifted across borders, reducing tax liabilities in their home countries. The scandal unmasked the clandestine role of these tactics in fueling the global tax evasion network.

The Role of Tax Havens: Tax havens, offering low tax rates and high financial secrecy, played a crucial role in the Panama Papers Scandal. Mossack Fonseca assisted clients in setting up offshore entities in various tax havens, further facilitating tax evasion and money laundering. The scandal underscored the need to address the issue of tax havens and their impact on global financial systems.

Politically Exposed Persons (PEPs): The scandal also shed light on the involvement of Politically Exposed Persons (PEPs) in global corruption. PEPs, individuals holding prominent public positions, were revealed to exploit offshore entities for personal gain. The inadequacy of existing due diligence procedures for PEPs was exposed, leading to a global demand for enhanced transparency and identification protocols.

Repercussions and Political Fallout: The fallout from the scandal was palpable, with notable figures facing public scrutiny. Iceland’s Prime Minister, Sigmund David Gunnlaugsson, resigned after the leak exposed his undisclosed interest in an offshore company. This incident resonated globally, prompting a reevaluation of transparency standards and the need for more stringent regulations.

The Significance of UBO Identification: The scandal underscored the growing importance of accurately identifying and verifying Ultimate Beneficial Owners (UBOs) of corporate structures. Global initiatives, such as the European Union’s 5th Anti-Money Laundering Directive and the U.S. Corporate Transparency Act, highlight the need for UBO transparency, making it harder for individuals to hide behind anonymous shell corporations.

The Data Leak Phenomenon and Its Impact: The unprecedented data leak that fueled the Panama Papers Scandal emphasized the dangers of unsecured data to individuals and businesses. The incident catalyzed a renewed focus on data security, leading to the implementation of stringent regulations like the EU’s General Data Protection Regulation (GDPR) in 2018.

The Call for Reform: The scandal exposed glaring loopholes in the global financial system, prompting calls for reform. Campaign finance systems and the regulation of tax havens came under scrutiny, with demands for enhanced disclosure standards and public access to prevent financial secrecy.

Conclusion: The Panama Papers Scandal served as a wake-up call, emphasizing the urgent need for greater transparency, stricter regulations, and international cooperation to curb corporate tax evasion. As the world moves forward, the lessons learned from this landmark incident must guide efforts towards a future where financial dealings are transparent, data is secure, and accountability is non-negotiable. The global community must remain vigilant, ensuring that the Panama Papers Scandal becomes a catalyst for positive change in the realm of financial governance.