In the world of personal finance and accounting, terms like gifts, inheritance, recourse, and non-recourse can be confusing. This blog will break down these concepts in simple language, provide examples, and explain how they are treated in the USA for 2024, including the accounting aspects.

Gifts

What is a Gift?

A gift is something of value given by one person (the donor) to another (the recipient) without expecting anything in return. Common examples include money, property, or even assets like stocks.

Example

If John gives $15,000 to his friend Mike for his birthday, that’s a gift.

Tax and Accounting Treatment

For the Donor

Gifts are not tax-deductible, and they must file a gift tax return (Form 709) if the gift exceeds the annual exclusion limit, which is $17,000 per person in 2024.

For the Recipient

Generally, gifts are not considered taxable income, so Mike wouldn’t pay taxes on the $15,000 received.

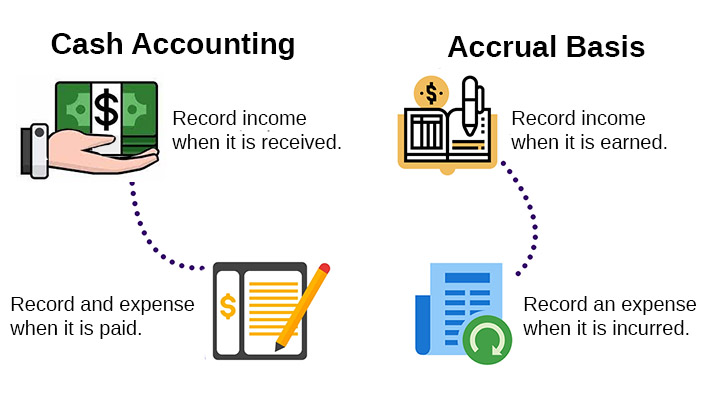

Accounting Treatment

For businesses, a gift is recorded as an expense when given. For individuals, no accounting entry is needed, as it’s personal.

Inheritance

What is an Inheritance?

Inheritance refers to assets or money received from a deceased person’s estate. This could be in the form of cash, real estate, or other valuables.

Example

Sarah inherits her grandmother’s house valued at $300,000.

Tax and Accounting Treatment

For the Recipient

In the USA, inheritance is generally not taxed as income. However, if Sarah sells the house, she may owe capital gains tax based on the difference between the sale price and the fair market value at the time of her grandmother’s death.

Estate Tax

The estate of the deceased may be subject to estate tax, but only if it exceeds the exemption limit, which is $12.92 million in 2024.

Accounting Treatment

For individuals, inherited assets are recorded at the fair market value at the date of death. For businesses, inheritance doesn’t directly apply, but similar principles are used for asset valuation.

Recourse Loans

What is a Recourse Loan?

A recourse loan allows the lender to pursue the borrower’s other assets if the collateral (like a house or car) isn’t enough to cover the debt.

Example

James takes a $100,000 loan using his car as collateral. If he defaults and the car sells for only $70,000, the lender can go after James’ other assets to recover the remaining $30,000.

Tax and Accounting Treatment

For the Borrower

If the lender forgives part of the debt, the forgiven amount may be considered taxable income.

For the Lender

The lender records the loan as an asset and reduces it when payments are made or the loan is settled.

Accounting Treatment

For businesses, recourse loans are recorded as liabilities. If part of the loan is forgiven, it’s treated as income.

Non-Recourse Loans

What is a Non-Recourse Loan?

A non-recourse loan limits the lender to only the collateral to satisfy the debt. If the collateral’s value is less than the outstanding debt, the lender cannot pursue the borrower’s other assets.

Example

Lena borrows $200,000 to buy a house. If she defaults and the house sells for only $150,000, the lender cannot go after her other assets for the remaining $50,000.

Tax and Accounting Treatment

For the Borrower

If the loan is settled through foreclosure and the forgiven debt exceeds the collateral value, the borrower may have to report the forgiven amount as income.

For the Lender

The lender can only claim the collateral value, and the rest is written off as a loss.

Accounting Treatment

For businesses, non-recourse loans are recorded as liabilities like recourse loans, but the accounting treatment in case of default differs, as only the collateral’s value is considered.

Conclusion

Understanding gifts, inheritance, recourse, and non-recourse loans is crucial for managing finances effectively. The tax implications and accounting treatments in the USA for 2024 are designed to ensure clarity and fairness. Whether you’re dealing with a generous gift, a heartfelt inheritance, or navigating the complexities of loans, knowing how these are treated can help you make informed decisions.