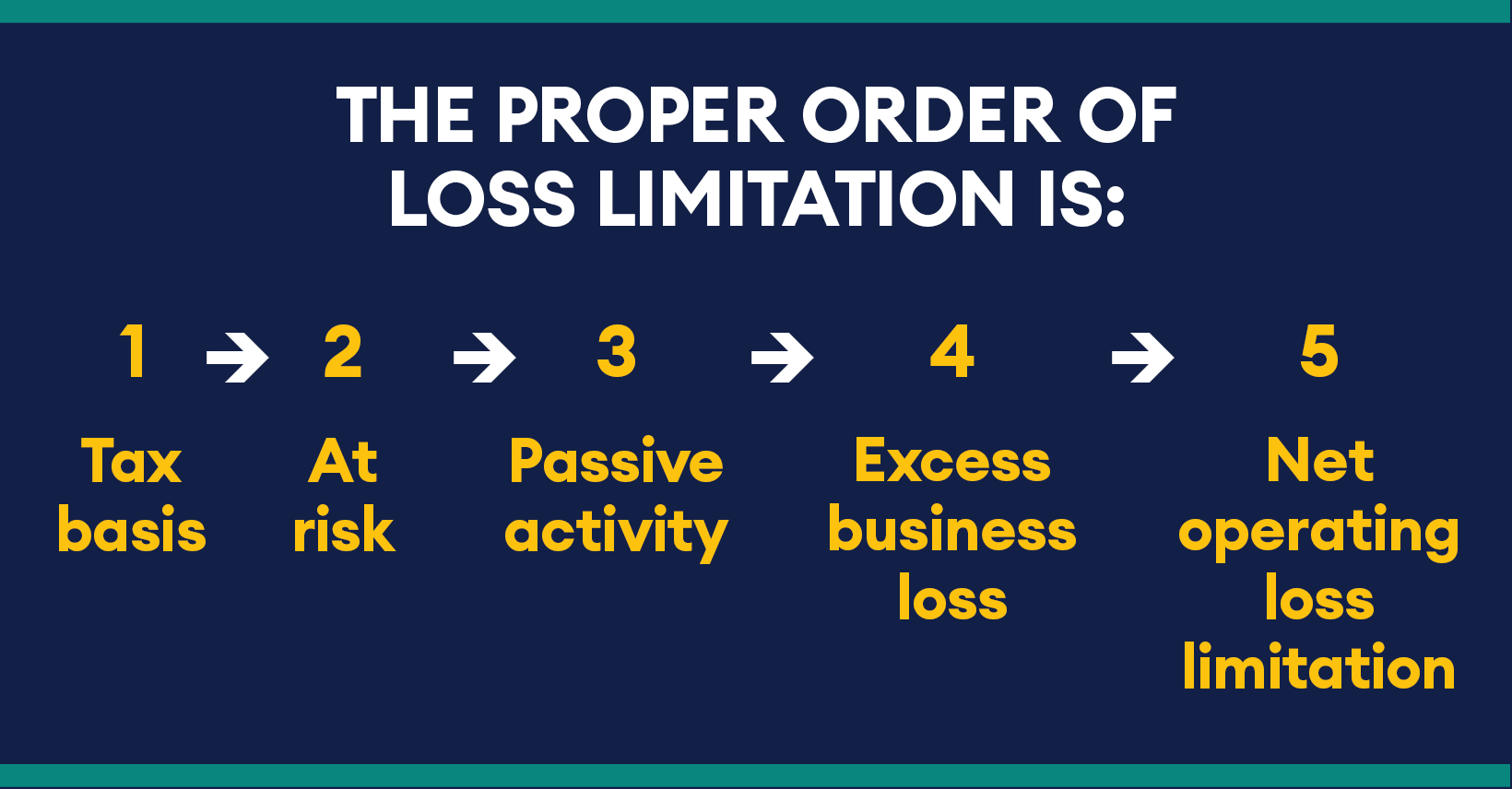

Navigating business losses can be tricky, especially with the various limitations set by the IRS. For 2024, two key rules to be aware of are the Tax Basis Loss Limitation and the Excess Business Loss Limitation. Here’s a simple guide to help you understand these limitations and how they impact your tax filings.

Tax Basis Loss Limitation

What is it?

The Tax Basis Loss Limitation rule restricts the amount of business losses you can deduct to the extent of your tax basis in the business. Essentially, your tax basis represents the amount you have invested in your business, including cash, property, and borrowed funds. You can only deduct losses up to the amount of your tax basis.

Example

Let’s say you invested $100,000 in your small business. If your business incurs a $120,000 loss over the year, you can only deduct $100,000 of that loss on your tax return—equal to your investment. The remaining $20,000 loss cannot be deducted in the current year. Instead, this amount is suspended and can be carried forward to future years, where it can be deducted if your tax basis increases.

If you sell your business or dispose of your interest, any suspended losses due to insufficient tax basis are typically lost.

Excess Business Loss Limitation

What is it?

The Excess Business Loss Limitation applies to non-corporate taxpayers, such as individuals, partnerships, and S corporations. It limits the amount of business losses that can be deducted in a given year. For 2024, the threshold is $610,000 for married couples filing jointly and $305,000 for all other taxpayers. If your total business deductions exceed this threshold, the excess is treated as a net operating loss (NOL) and carried forward to future years.

Example

Suppose you’re married and filing jointly with $1,000,000 in business deductions but only $300,000 in business income for 2024. Your net business loss is $700,000 ($1,000,000 – $300,000). Due to the Excess Business Loss Limitation, you can only deduct $610,000 of that loss in 2024. The remaining $90,000 ($700,000 – $610,000) will be carried forward as a net operating loss (NOL) to offset future taxable income.

How to Calculate

Determine Your Total Business Income

Sum up all sources of business income, such as earnings from sales, services, and other business activities.

Calculate Your Total Business Deductions

Add up all eligible business deductions, including salaries, rent, supplies, and other business expenses.

Subtract Deductions from Income: The result is your net business loss.

The result is your net business loss.

Apply the Excess Business Loss Limitation

If your loss exceeds $610,000 (for married filing jointly) or $305,000 (for other taxpayers), the excess is carried forward as a net operating loss.

Need Assistance?

Understanding these limitations can help you make the most of your business losses and avoid unexpected surprises come tax time. If you have questions or need help with your tax filings, don’t hesitate to reach out!