When it comes to accounting, understanding different methods and concepts like the Accrual Method, Cash Method, Realization, and Recognition is crucial for businesses to manage their finances effectively. This blog will break down these terms in simple language, provide examples, and show how they impact the financial statements—making it easier for you to grasp.

Accrual Method

Definition

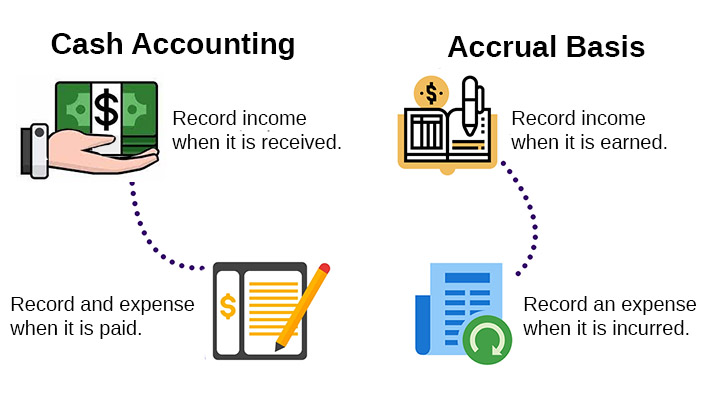

The Accrual Method records revenues and expenses when they are earned or incurred, regardless of when the cash is actually received or paid. This method gives a more accurate picture of a company’s financial health over time.

Example

Scenario

A company delivers a service in December 2024 but receives payment in January 2025.

Accounting Treatment

Under the accrual method, revenue is recorded in December 2024 when the service is performed, not in January 2025 when the cash is received.

Journal Entry

December 2024

- Debit: Accounts Receivable (Asset) $1,000

- Credit: Service Revenue (Income) $1,000

January 2025

- Debit: Cash (Asset) $1,000

- Credit: Accounts Receivable (Asset) $1,000

Impact on Financial Statements

Statement of Financial Position (Balance Sheet)

In December, Accounts Receivable increases, reflecting the amount owed by the customer.

Statement of Profit and Loss (Income Statement)

Service Revenue is recorded in December, showing the income earned.

Cash Method

Definition

The Cash Method records revenues and expenses only when cash is received or paid. This method is simpler but may not reflect the company’s true financial situation as accurately as the Accrual Method.

Example

Scenario

Using the same example, the company delivers a service in December 2024 but receives payment in January 2025.

Accounting Treatment

Under the cash method, revenue is recorded in January 2025 when the cash is received.

Journal Entry

January 2025

- Debit: Cash (Asset) $1,000

- Credit: Service Revenue (Income) $1,000

Impact on Financial Statements

Statement of Financial Position (Balance Sheet)

Cash increases in January when payment is received.

Statement of Profit and Loss (Income Statement)

Service Revenue is recorded in January, showing income earned when cash is received.

Realization Concept

Definition

The Realization Concept determines when revenue is considered earned and can be recognized in the financial statements. Revenue is realized when goods are sold or services are provided, regardless of cash receipt.

Example

Scenario

A company sells goods on credit in November 2024. The customer pays in February 2025.

Accounting Treatment

Revenue is realized in November 2024 when the sale occurs.

Journal Entry

November 2024

- Debit: Accounts Receivable (Asset) $2,000

- Credit: Sales Revenue (Income) $2,000

Impact on Financial Statements

Statement of Financial Position (Balance Sheet)

Accounts Receivable increases in November.

Statement of Profit and Loss (Income Statement)

Sales Revenue is recorded in November, reflecting the realized revenue.

Recognition Concept

Definition

The Recognition Concept determines when to include income or expenses in the financial statements. Revenue is recognized when it is earned, and expenses are recognized when incurred, following the matching principle.

Example

Scenario

A company receives an advance payment of $3,000 in October 2024 for services to be delivered in December 2024.

Accounting Treatment

Revenue is recognized in December 2024 when the service is performed, not when the cash is received.

Journal Entry

October 2024

- Debit: Cash (Asset) $3,000

- Credit: Unearned Revenue (Liability) $3,000

December 2024

- Debit: Unearned Revenue (Liability) $3,000

- Credit: Service Revenue (Income) $3,000

Impact on Financial Statements

Statement of Financial Position (Balance Sheet)

In October, Unearned Revenue is recorded as a liability. In December, it is moved to Service Revenue.

Statement of Profit and Loss (Income Statement)

Service Revenue is recognized in December when the service is provided.

Conclusion

Understanding the Accrual Method, Cash Method, Realization, and Recognition concepts helps you better grasp how revenue and expenses are recorded and how they impact financial statements. The Accrual Method gives a more accurate view, while the Cash Method is simpler. Realization and Recognition ensure that income and expenses are recorded in the right period, reflecting the company’s true financial health. By knowing these basics, you can make more informed decisions about your business finances.